Portfolio Impact & Returns Analysis for 120878323, 46819551, 1903919817, 649776232, 914842500, 1422746204

The Portfolio Impact & Returns Analysis for the specified identifiers presents a comprehensive evaluation of performance metrics and risk exposure. Each portfolio’s response to market volatility and economic indicators is examined closely. Individual risk tolerance plays a critical role in determining potential returns. The following sections will uncover strategic insights that can enhance decision-making processes. Understanding these aspects may reveal pathways to optimize portfolio performance and align with investment objectives.

Overview of Portfolio Identifiers

Portfolio identifiers serve as essential tools for categorizing and analyzing investment portfolios, enabling investors to assess performance and risk more effectively.

These identifiers facilitate the classification of various portfolio types and align them with specific investment strategies. By utilizing distinct identifiers, investors can gain insights into diversification, asset allocation, and risk exposure, ultimately enhancing decision-making processes and fostering a sense of financial autonomy.

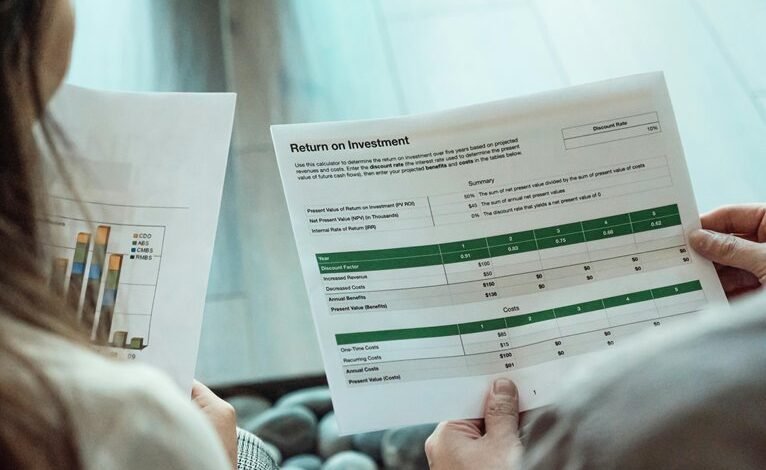

Performance Metrics Analysis

Performance metrics play a crucial role in evaluating the effectiveness of investment portfolios, providing a quantitative framework for assessing returns relative to risk.

Through performance benchmarking, investors can compare portfolio outcomes against established standards, facilitating informed decision-making.

Furthermore, comprehensive risk assessment enables stakeholders to gauge potential volatility, ensuring that the pursuit of returns aligns with their risk tolerance and investment objectives.

Factors Influencing Returns

Returns on investment are influenced by a myriad of factors that can significantly affect portfolio outcomes.

Market volatility and economic indicators play critical roles in shaping performance. An investor’s risk tolerance and asset allocation strategies determine their exposure to these fluctuations.

Furthermore, a well-defined investment horizon and effective diversification strategies can mitigate risks, enhancing potential returns and providing the freedom to navigate changing market conditions.

Strategic Insights for Investors

Investors must consider various strategic insights to optimize their decision-making processes in light of the factors influencing returns previously discussed.

Effective risk management is paramount, enhancing resilience against market volatility.

Furthermore, diversifying investment strategies can mitigate potential losses while maximizing returns.

Conclusion

In conclusion, while some portfolios exhibit robust performance metrics that promise potential returns, others reveal vulnerabilities amid market volatility and economic fluctuations. Balancing risk tolerance with strategic diversification emerges as a crucial theme, enabling investors to navigate the dichotomy between high reward and potential loss. By aligning investment objectives with meticulous risk management strategies, stakeholders can enhance their financial outcomes, transforming uncertainty into opportunity within the dynamic landscape of portfolio management.