United States:Gibmrctfnhy= Map

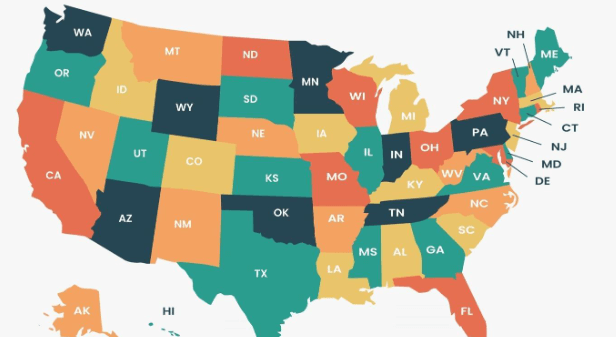

The Gibmrctfnhy Map represents a significant advancement in the field of digital cartography, providing an intricate view of the United States that merges geographic features with political boundaries. This interactive tool not only enhances user engagement but also facilitates a nuanced understanding of regional dynamics through real-time data integration. As we examine the implications of such innovations, one must consider how these developments influence our perception of spatial relationships and the broader sociocultural landscape. What does this mean for future decision-making processes across various sectors?

Overview of Gibmrctfnhy Map

The Gibmrctfnhy Map serves as a comprehensive representation of geographic features and political boundaries within the United States, providing critical insights into spatial relationships and demographic distributions.

This map facilitates interactive mapping, allowing users to engage with gibmrctfnhy features, enhancing their understanding of regional dynamics.

See also: Ultra Hd:Qdkpnnex7y4= Goku Wallpaper

Technological Innovations in Cartography

Advancements in technology have significantly transformed cartography, enhancing the accuracy, accessibility, and interactivity of maps used to represent the diverse geographic and political landscapes of the United States.

Digital mapping technologies have emerged, allowing for real-time data integration and offering interactive features that empower users to engage with geographic information dynamically.

This transformation fosters a deeper understanding of spatial relationships and promotes informed decision-making.

Impact on Geographic Understanding

As digital mapping technologies have proliferated, they have profoundly reshaped geographic understanding by enabling users to visualize complex data sets and spatial relationships with unprecedented clarity and detail.

This shift enhances cultural perspectives by fostering awareness of diverse environments and social dynamics.

Moreover, the educational implications are significant, as these tools facilitate interactive learning experiences that empower individuals to engage with geography in meaningful, informed ways.

Conclusion

In conclusion, the Gibmrctfnhy Map exemplifies the extraordinary evolution of electronic exploration, enhancing understanding of the United States’ complex cartographic landscape.

Through technological triumphs and innovative integration, this mapping marvel fosters formidable insights into geographic and demographic dynamics.

By bridging boundaries and bolstering awareness, the map serves as a significant tool for informed decision-making and societal sensitivity.

Ultimately, the Gibmrctfnhy Map stands as a testament to the transformative power of digital cartography in contemporary scholarship.